Audience members listen as President Obama delivers his State of the Union Address.

The moral case President Obama has made to explain his “Buffet Rule” proposal is pretty simple. “Let me tell you something,” Obama told a crowd in Iowa on Wednesday, “asking a billionaire to pay at least as much as his secretary, that’s just common sense.” But the policy rationale behind that statement is far less clear cut.

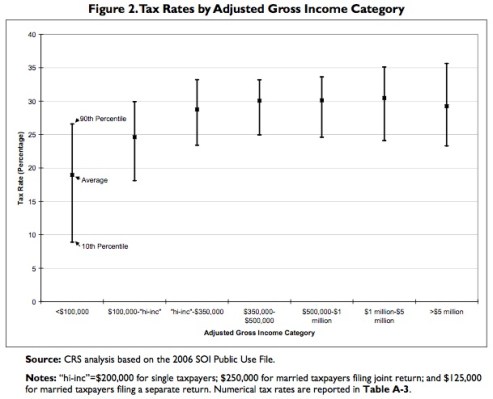

As it now stands, most people who earn more than $1 million pay a greater share of their income to the federal government than those in the middle class. But at the edges, there is some overlap. As Obama accurately put it, “A quarter of all millionaires pay lower tax rates than millions of middle-class households.” That number comes from an October 7, 2011 analysis by the Congressional Research Service, which contains a helpful graph that explains the dynamic.

The vertical lines show the range of taxes paid by Americans in various income brackets. As you can see, wealthier people generally pay more taxes. There is some overlap, but the overlap is pretty tiny in a country of 250 million people. “Roughly a quarter of all millionaires (about 94,500 taxpayers) face a tax rate that is lower than the tax rate faced by 10.4 million moderate- income taxpayers (10% of the moderate-income taxpayers),” the report concludes. No one has yet scored exactly how many taxpayers will be effected by Obama’s Buffet Rule proposal, which would essentially establish a 30% alternative minimum tax for those who make more than $1 million a year. But it is a safe bet that it is in the same ballpark. In other words, we are only talking about roughly 94,500 families getting a tax increase, or roughly as many people as live in Hillsboro, Oregon.

Obama is pitching the Buffett Rule as having major savings potential. “If the country was in a surplus like it was back in 2000, I’d understand us saying, well, let’s try to let millionaires keep every last dime,” he said in Iowa. “I get that. But that’s not the situation we’re in. And so we’ve got to make choices. Do we want to keep investing in everything that’s important to our long-term growth — education, medical research, our military, caring for our veterans — all of which are expensive? Or do we keep these tax cuts for folks who don’t need them and weren’t even asking for them? Because we can’t do both.”

But it is notable that President Obama does not plan to ask for the Buffett Rule as legislation, which would trigger an official budgetary score. He wants to use it as a values issue to draw contrast with the Republican Party in general, and Mitt Romney, who is one of the 94,500, in particular. Some basic math can tell you that no matter how good progressive taxation might be for the nation’s soul, getting this rule into place is unlikely to have any big impact on Uncle Sam’s bottom line. Daniel Indiviglio, of The Atlantic, did some back-of-the-envelope calculations on this last fall. He found that even if you taxed millionaires at some ridiculous rate, like 100%, you would not come close to closing the budget deficit. The likely impact is much smaller.

But its an issue that has more campaign resonance than the big changes that would really deal with the nation’s fiscal dilemma, like reforming Medicare and Medicaid. It’s also a value issue for Obama. It is meant to get voters to identify with him, and not the other guy. It’s about “fairness” more than fiscal sanity. And you will be hearing a lot more about it.