In 2008, I found myself in the Crystal City office of Doug Holtz-Eakin, the top economic adviser to Republican presidential nominee John McCain. When talk turned to Social Security, he said a version of what just about every serious fiscal analyst says these days: This is not that hard of a nut to crack. Sure there is a debate about just how to fix the program–a choice between shaving benefits, raising the retirement age and raising revenue–but the math is not that daunting.

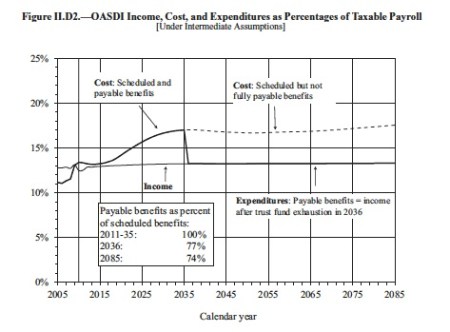

How far we have come. Three years later, Republicans are debating whether the program is a “Ponzi scheme.” Below is a chart from the last Social Security trustees report. As Michael Crowley notes, this is not a picture of a house of cards about to collapse:

In short, this chart says the following: Starting in 2035, there will not be enough money in the current Social Security system to pay benefits as promised. But that doesn’t mean the program will collapse. If Congress does absolutely nothing, beneficiaries will continue to get 74% of their benefits through 2085, which is just about as far into the future as anyone can pretend to see.

Now this is a problem–losing a quarter of one’s income is no small thing–but it is not a Bernie Madoff-type problem. The program is not a bunch of smoke and mirrors that could evaporate in an instant. The Securities and Exchange Commission defines Ponzi Scheme as follows:

A Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claimed to generate high returns with little or no risk. In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors and to use for personal expenses, instead of engaging in any legitimate investment activity.

Now it is certainly true that Social Security is set up so that current investors–those who are working and paying taxes into the program–pay returns for current retirees. But beyond that, it’s hard to see how Social Security meets the definition of a Ponzi Scheme. It is not a fraud. It’s workings are entirely transparent. And the risks are clearly known. (See chart above.)

So Texas Gov. Rick Perry’s use of the term “Ponzi Scheme” must be read a political rhetoric, not anything more or less. He is exaggerating the peril of the program to make a political point. This is where it gets interesting. What point is Perry trying to make? Is he trying to argue that the Social Security program should be phased out? Is he arguing against the consensus adjustments that the McCain campaign agreed would eventually have to be made, even if there was not yet agreement on the details? Does he want to go back to a private-account investment plan, either with the Chilean model or the plan that George W. Bush proposed in 2005? Is he just trying to look like he won’t back down from his last book?

My suspicion is that in the next several days, Perry will be forced to clarify just what he wants to do with the program. But when he does, let us all remember that this scheme is no big mystery. Everyone knows the problem. It’s not collapse. It’s a 25% shortfall in needed funds. And there are hundreds of different ways to fix it.