The president’s “National Commission on Fiscal Responsibility and Reform,” chaired by Democrat Erskine Bowles and former Republican Senator Alan Simpson, held its first official meeting this morning at the White House. Speaking about the endeavor, Obama pointed to the challenges financial crisis and economic downturn thrust on the government and the necessities of the stimulus before pivoting to the importance of restoring PAYGO, bragging about his proposed discretionary spending freeze and plans to cut waste. And then he acknowledged the hard truth: Those things don’t amount to diddly. (Well, OK. He said, “All these steps, while significant, are simply not enough,” but you get the idea.)

Pretend for a moment the bipartisan deficit commission made unprecedented proposals that blew the most ballyhooed budget complaints out of the water. They could recommend constitutional amendments banning government bailouts, Keynesian stimulus and congressional earmarking outright. They could eliminate all non-military foreign aid, put a permanent cap on defense spending at current levels, outlaw future tax cuts or close every tax exemption on the books. All of these things are politically unfeasible, many of them are ill-advised and none of them will ever happen. But let’s pretend. After all that, America’s long-term fiscal outlook would still be dim. Here’s why:

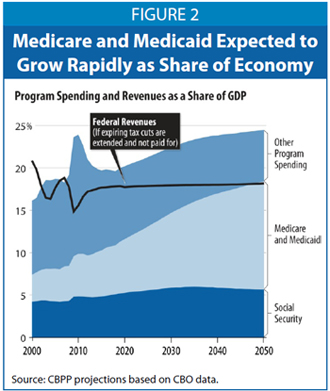

That graphic is from the Center on Budget and Policy Priorities and its trend line shows that Medicare, Medicaid and Social Security costs will catch up to the entirety of federal revenue as a percentage of GDP in coming decades if things don’t change. Addressing the problem is not as simple as entitlement reform — the two main factors at play in the explosion of Medicare and Medicaid costs are health care inflation and an aging population; finding out which cost controls from the new health care law work and aggressively applying them could dramatically change the picture. But the more straightforward revenue vs. expenditure considerations for Medicare, Medicaid and Social Security are still bound to be part of any serious discussion of long-term deficit reduction.

Now to the politics. There is simply nothing more politically toxic than this issue. When Democrats proposed cuts to Medicare Advantage — a program that gives money to seniors to buy private insurance rather than covering them under Parts A and B — as part of the the health care overhaul, the GOP cried bloody murder. When Republican Paul Ryan proposed his fiscal “Roadmap,” Democratic Rep. John Larson said its proponents were “frozen in the ice of their own indifference.” The merits of these policies aside, it’s clear that any discussion of the big three entitlements is given to reactionary hyperbole.

What about raising revenues? On April 6, White House adviser Paul Volcker, responding to a question about the feasibility of a value-added tax, said a VAT “was not as toxic an idea” as many supposed and that, “If at the end of the day we need to raise taxes, we should raise taxes.” He was decidedly wrong about that first part. A firestorm of angst ensued and, less than two weeks after Volcker’s comments, the Senate passed a purely symbolic “sense” amendment by a whopping majority of 85-13 stating the upper chamber would oppose any move to institute a VAT. One more political sticking point: During the campaign, Obama pledged not to raise taxes on families making less than $250,000 per year. It’s easy enough for critics to argue a VAT, levied on producers of goods who in turn pass that cost on to consumers, breaks his pledge. For the more rhetorically unhinged, there’s always this: Most European countries use a broad-based consumption tax like the VAT instead of more heavily taxing income as the United States does. If you thought cries of “European Socialist” were loud during the health care debate, just you wait until Comrade Simpson and Comandante Bowles propose new revenue streams.

Perhaps the central political challenge of serious deficit reduction is that there’s only one easy villain. Health reform had profit-obsessed, claim-denying insurers. Financial reform has mortgage-swindling, economy-tanking fat cat Wall Streeters. With budget matters, there’s no foil for reformers to play against. People love their government goodies and hate paying for them, plain and simple. Whoever tries to raise taxes or cut entitlements quickly becomes the monster. And that’s why presidents try to shield themselves with bipartisan commissions — the recommendations provide a way to argue for change without being the progenitor of unpopular policy. George W. Bush had to use “The President’s Commission to Strengthen Social Security” in his privatization push. Bill Clinton and the Republican Congress needed the “National Bipartisan Commission on the Future of Medicare” before touching said program in the late ’90s.

And that brings us back to Simpson and Bowles. Today, in an interview with MSNBC’s Andrea Mitchell, the pair’s purpose was on display. After recounting how his own mother begged him to keep his hands off Medicare, Bowles said, “We have to touch Medicare. We have to touch Social Security. We have to touch the military. And we have to take a strong look at revenue.” Simpson agreed, “Everything is on the table.” The commission is scheduled to report its findings in December. That’s when we find out what made it from the table to the chopping block.