The effects of sequestration and payments from Fannie Mae and Freddie Mac gave the U.S. Treasury its largest monthly surplus since before the financial crisis.

According to Treasury’s Financial Management Service, the federal government took in $116.5 billion more than in spent in June, as the annual federal deficit is predicted to fall to roughly $642 billion according to the Congressional Budget Office (CBO) from $1.1 trillion in fiscal year 2012. Last June the treasury ran a $59.7 billion deficit.

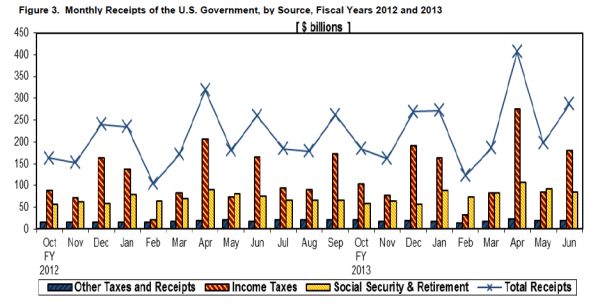

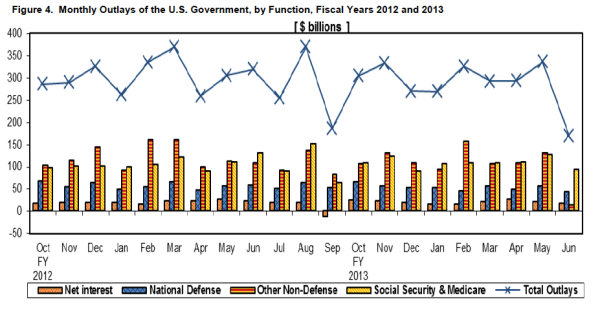

Federal revenues and outlays fluctuate monthly due to seasonal variations. A $113 billion surplus in April was largely the result of income tax payments around the tax filing deadline. In June, Fannie Mae and Freddie Mac, two federally-backed companies that support the U.S. mortgage market, delivered a combined $66 billion to the federal treasury after strong earnings in the first quarter of the year—substantially inflating the surplus sum. Spending in June declined to a level not seen in nearly a decade, falling to $170 billion — the lowest since a $161 billion month in November 2004.

According to a CBO analysis, outlays for student loans decreased by $5 billion, spending on Medicare and Medicaid fell by $4 billion and $2 billion, respectively, and defense spending dropped by $5 billion compared to the same month in 2012 when timing shifts are included. Income and social security taxes increased due to the ending of the Bush tax cuts on the wealthiest earners and the payroll tax cut in January, and corporate tax receipts jumped by $6 billion (roughly 10%) due to higher corporate profits.

The surprise surplus presents another obstacle to talks around a “grand bargain” deficit deal this fall, when Congress will be faced with further expending the U.S. debt limit. With annual deficits falling and economic activity picking up, the urgency that has existed in recent years is waning.