President Barack Obama delivers remarks on the budget alongside acting Director of Office Management and Budget Jeff Zients, in the Rose Garden of the White House in Washington, April 10, 2013.

President Obama will release a “fiscally responsible” budget for the country today, his aides say. This is not news. It happened last year. And the year before. And the year before. In Obama’s first year, he was so confident, he called his budget “A New Era of Responsibility.”

Except, it wasn’t. And never really has been. Because the fiscally responsible part is always projected to begin a few years in the future, and each year, as a new budget comes out, White House aides have also revised their projections. What they believed to be responsible before was not so responsible after all. The deficits were larger than they expected. The economy grew slower. The debt was bigger.

There is some disagreement over just what “fiscally responsible” means. Some liberals believe there is no real risk of running up too much debt, given the demonstrated willingness of the world to buy our bonds, so it is responsible to accept our high deficits. Some conservatives believe that any deficits are a moral outrage that will turn our children into chattel or preface armageddon, so it is responsible to embrace austerity. For the purposes of this post, I am defining “fiscally responsible” as it is most often meant by the White House: charting a path to deficit levels that roughly stabilizes the size of the debt as a percentage of GDP.

In 2009, Obama’s propeller heads predicted the deficits in 2012 would be about 4.6% of GDP, or just slightly higher than the growth of the economy. Three years later, Obama’s number crunchers were saying that the 2012 deficit would be 7.2% of GDP, which means the original prediction was off by about 50%. Why? The biggest reason is that the financial crisis was worse than predicted, and the recovery has been slower, lowering tax revenue. It’s also true that Congress never puts a White House budget into law, but as this chart by The Washington Post’s Dylan Matthews shows, had Obama had his way, the deficits would likely have been worse, not better. The budget that Congress passed in 2009 was 3% smaller that Obama wanted; it was 7% smaller in 2010.

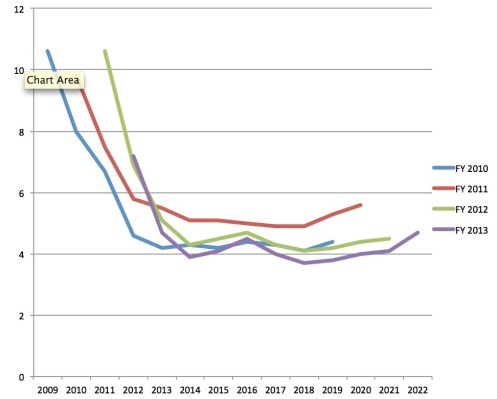

But the pattern in the Obama administration has been remarkably consistent: Presidential budgets are a terrible source for predicting the fiscal responsibility of the U.S. government. Here is a line chart I made showing the deficit projections Obama made in each of his first four budgets, as a percentage of GDP. As you can see, each year the short-term projections tend to get a little worse.

The number crunchers across the street from the White House are not fudging the numbers. The problem is that lawmakers do not have complete control over deficits. The economy matters, and the official numbers have not been good at predicting what will happen.

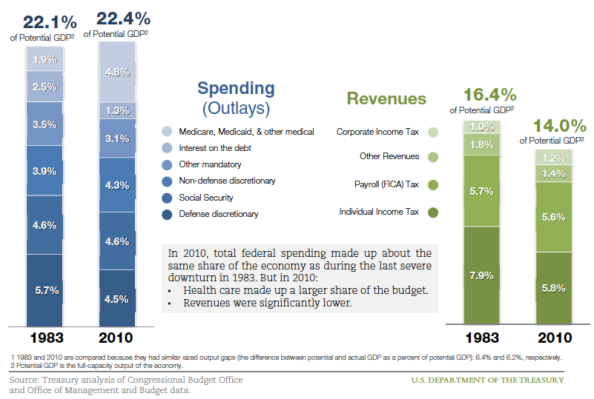

The other thing worth mentioning here is that in discussions of fiscal responsibility, the President’s budget is often a distraction. The real problems with spending and taxation have little to do with what Obama likes most to talk about: new bridges, pre-K education, tax loopholes for the very wealthy. They have to do with long term trends—a decrease in tax rates and revenue over the last decades, and an increase in the cost of health care. The graphic designers at the U.S. Treasury clearly illustrate this point:

Any long term solution to the high deficits will most certainly arise from addressing these areas. And that deal, if it happens anytime soon, will not be found in the Obama budget document, though his recent embrace of cuts to Social Security and Medicare may be a step in that direction.

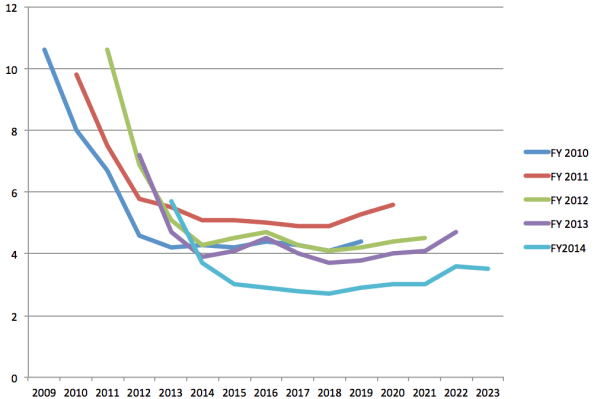

UPDATE: I have added below another line (in teal) to my chart, showing the deficit projections as a percentage of GDP from the most recent budget, fiscal year 2014, which was released Wednesday afternoon. You will see that the deficit estimates for the most immediate year are once again higher than they were predicted to be last year, the year before, the year before that, etc. Not exactly the kind of projections you want to take to the bank, or bond market. To read the whole budget, see here.