Paul Ryan, Chairman of the House Budget Committee, joins with other members of the committee as he departs a press conference at the U.S. Capitol where he unveiled his budget plan on March 12, 2013 in Washington, D.C.

If you’re not too interested in budget details, which is to say you’re a normal person, here are the basics of House Budget Chairman Paul Ryan’s latest plan: He wants deep cuts in Medicaid, the health program serving the poor, the near-poor, the disabled, and nursing homes. He wants to transform Medicare from an entitlement for senior citizens into a voucher program, but only starting in 2024, so the changes wouldn’t affect the 55-and-over set that tends to vote Republican. He wants to rein in general spending, except for military spending. And he wants to slash tax rates for wealthy individuals and corporations to 25%, while making up the lost revenue with unspecified “reforms.” If this sounds a lot like the plans Ryan unveiled in 2009 and 2011—with a hint of the Romney-Ryan budget plan from 2012—well, it is. Ryan is under no obligation to revise his plans just because a majority of the electorate rejected them, although it is amusing to see him claim (p. 5) that “most Americans” share his dystopic view of the nation’s current path.

My beef with Ryan 3.0–like my critique of the “radical document” that was Ryan 1.0, and my screeds about the media gushfest over Ryan 2.0– is that it gets the problem wrong and the solution wrong. It would hurt people who need help and helps people who don’t. And while Ryan deserves some credit for taking some political risks, his budget is still brimming with the dishonesty and hypocrisy that often characterizes the modern Republican Party. A few specific examples:

“The Current Mess.” (p. 4) In his introduction, Ryan argues that his plan, designed to balance the federal budget in 10 years, is needed because America is going to hell. He identifies the problem as an out-of-control deficit created by out-of-control spending. If we don’t act now, he says, we’ll have a “debt crisis,” followed by “debasement of our currency,” and a parade of horribles: “Our finances will collapse. The economy will stall. The safety net will unravel.” His budget is “an exit ramp from the current mess.”

(MORE: Dueling Budgets and a Window for a Grand Bargain)

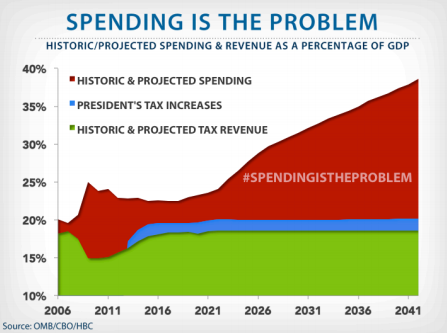

But what mess? On page 13, Ryan helpfully provides a graph (posted below) titled “Spending Is The Problem,” which actually shows that spending has declined as a percentage of GDP since the dark days of socialism began in 2009, and is on track to keep declining throughout the Obama presidency. There’s another fun graph (also posted below) on page 72, a reminder that the deficit, estimated at $1.2 trillion when Obama took office, is now down to $850 billion, and is on track to fall to $400 billion by the end of the president’s second term.

In fact, government spending in the Obama administration has increased at the slowest rate since the Eisenhower administration. And the markets that Ryan normally worships clearly don’t think we’re headed for a debt crisis, because interest rates are at historic lows. Ryan says that this is because “investors have retreated to U.S. securities amid global turmoil”—in other words, they have more confidence in the U.S. than any other issuer of debt—but that “our growing obligations may shake their confidence.” Investors are aware of our obligations. They don’t seem shaken. Our crisis is persistent unemployment, and instant austerity would just make it worse.

“Fundamental Tax Reform.” (p. 24) Ryan is so worried about the gap between Uncle Sam’s inflow and outflow that his first big proposal is…you guessed it…to reduce inflow by slashing corporate and individual tax rates and eliminating the alternative minimum tax. His ambitious tax cuts could reduce federal revenues by $5 trillion over a decade. But never fear: Ryan intends to make up that revenue by well, he doesn’t say. Maybe he wants to gut trillions of dollars worth of tax breaks and popular deductions, but doesn’t want to take the political heat. Maybe he just wants to do the fun side of tax reform, which would be fiscally irresponsible, but would at least provide a bit of stimulus. In any case, he’s very specific about deficit-exploding tax cuts, and curiously silent about the deficit-reducing tax increases that would make reform pay for itself.

“This budget repeals the President’s onerous health-care law.” (p. 33) This may seem like an odd way to eliminate the deficit, since the Congressional Budget Office concluded that Obamacare will substantially reduce the deficit. And of course repeal could never happen while Obama is in office; it’s just a budget gimmick. But it’s a telling gimmick. While Ryan’s budget repeals Obamacare’s benefits, like its expansion of Medicaid to millions of low-income working families, it doesn’t eliminate the revenues raised by Obamacare’s new taxes, because he needs them to achieve balance on paper. Ryan would also eliminate Obamacare’s fledgling efforts to rein in federal health spending, by far the leading driver of long-term federal deficits. Which is more evidence that the alleged “fiscal conservative” who voted for the deficit-exploding Bush tax cuts, the Bush military and security spending binge, the Medicare prescription drug benefit, the bank bailout, and the auto bailout—but against the Bowles-Simpson deficit reduction plan—does not really care about the deficit. No matter how much he talks about it.

(MORE: Does President Obama Really Believe in Deficit Reduction?)

“Safety Net Strengthened.” (p. 27) If by “strengthened,” Ryan means “cut,” then sure, that’s what his budget will do. It trims Pell Grants to low-income students. It achieves two-thirds of its savings by rolling back Medicaid and Obamacare—health care for moderate-to-low-income families. To Ryan’s credit, he endorses Obama’s plan to require higher-income seniors to pay higher Medicare premiums, but in the long term his Medicare reforms will squeeze the benefits of seniors, which is why he didn’t dare propose those reforms for the seniors of today. And if Ryan is serious about keeping tax reform revenue-neutral he’ll have to jack up taxes on the poor and middle class to pay for his tax cuts for corporations and the rich.

“Government spending is no substitute for a true recovery.” (p. 55) The public sector has lost more than half a million jobs in the Obama era, but conservatives like Ryan have to pretend there’s been an unprecedented expansion of Big Government. I get that. And I wasn’t surprised to see Ryan peddling all kinds of bogus information about clean energy and the 2009 stimulus; I’ve called him out his lies on those topics before, but it’s typical from a right-wing Republican lawmaker in the Obama era. What really bugged me was Ryan’s utter failure to go after genuine government excesses and unnecessary programs, which I always thought was the reason God invented right-wing Republicans. But Ryan wants to run for president in 2016, and most Americans who hate “spending” still tend to like the actual stuff government spends money on. So aside from his Medicaid and Medicare reforms, plus a few Tea Party bugaboos like clean energy loans and high-speed rail, Ryan left any specific cuts up to congressional committees. For example, even though there’s broad agreement across the ideological spectrum that U.S. farm subsidies are a national embarrassment, Ryan proposed to cut overall farm spending by a measly $3 billion a year—while allowing the in-the-tank Agriculture Committee to determine where to cut.

If I had to choose the most telling sentence in Ryan’s document, it would probably be this one on page 56: “This budget proposes to reduce the federal auto fleet (excluding the Department of Defense and the U.S. Postal Service) by 20%.” Why on earth would a conservative who cared about the deficit exclude the Pentagon and USPS, which have the largest fleets? Because the defense lobby loves bloated Pentagon spending. Because the rural lobby* loves USPS, which is about as obsolete as the Pony Express. And for the umpteenth time, Paul Ryan doesn’t really care about the deficit.

MORE: Despite Talk of Cuts, Members of Congress Push More Spending

*Correction, 1:30pm.: This post has been changed from “farm lobby” to “rural lobby.” TIME regrets the error.