White House Press Secretary Jay Carney finally got a question today about the possibility of inventing a a $1 trillion platinum coin to magically solve the coming debt ceiling crises, an outlandish idea that the Internet loves. Despite repeated questioning, he refused to rule out categorically the possibility of minting such a coin. But he also made clear that it is not a current option under consideration.

“The option here is for Congress to pay its bills,” Carney said, after flipping to a page in his briefing book that appeared to anticipate the question. “There is no Plan B. There is no backup plan.There is Congress’s responsibility to pay the bills of the United States.”

The answer was far less direct than the answer Carney has given when asked about another controversial route for the White House to evade the debt ceiling: The unilateral raising of the debt ceiling by the President under the argument that the 14th Amendment of the Constitution grants that power. “This administration does not believe the 14th Amendment gives the president the power to ignore the debt ceiling,” Carney said in December.

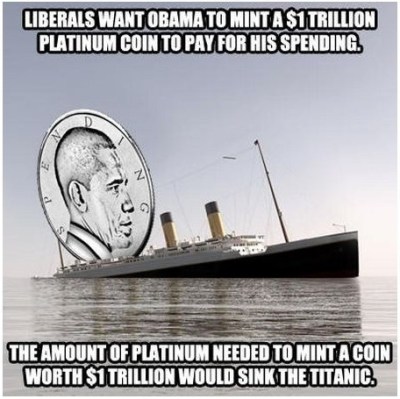

Meanwhile, Republicans have begun to jump on the viral potential of the $1 trillion platinum coin, releasing this graphic over Twitter today.

Of course the graphic has little factual relation to the way modern currency works. The value of a dollar bill is not measured by the value of its paper, nor is the value of a quarter measured by the value of its copper and nickel. If the legal theory behind the $1 trillion coin has any merit (and that is a big if) and if the introduction of a $1 trillion coin does not dramatically unsettle currency markets (and that too is a big if), than the weight of the coin should not be an issue.

UPDATE: On January 12, the Treasury Department nixed the $1 trillion coin option. “Neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit,” Treasury spokesman Anthony Coley said.