U.S. President Barack Obama delivers a statement calling for a one-year extension of Bush-era tax cuts, in the East Room of the White House in Washington, July 9, 2012.

President Obama said Monday that he wants Congress to immediately pass an extension of the 2001 and 2003 Bush tax cuts for families’ first $250,000 in income. Republicans won’t do this unless Obama agrees to extend the tax cuts on income above $250,000 as well, which allows Obama to argue that Republicans and Mitt Romney are in league with Richie Rich, Scrooge McDuck and Jay Gatsby.

But it’s not just Republicans–or at least it didn’t used to be. A number of high-ranking Congressional Democrats, most of whom represent wealthy parts of the country, have long argued that the $250,000 cut off is too low. House Minority Leader Nancy Pelosi of San Francisco and Senator Chuck Schumer of New York have pushed a $1 million cutoff–until Monday when they backed off their proposals and fell into line with the President. But that doesn’t mean the $1 million compromise line won’t resurface in negotiations with Congress if President Obama wins reelection. (A handful of other Democratic Senators have expressed support for a higher cutoff.)

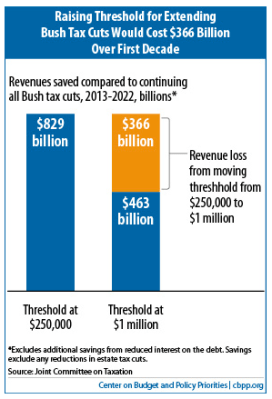

So what’s the big practical difference between $1 million and $250,000? It matters a great deal if you care about reducing the federal deficit to sustainable levels. It is, in real ways, the difference between tax increases that make a dent in the budget deficit and tax increases that just make a scratch. That’s because its easier to raise revenue by raising taxes on a larger group of people, and there are a lot more families making more than $250,000 than making more than $1 million. According to the Joint Committee On Taxation, the Obama plan, to return to pre-Bush rates on all income over $250,000, would raise $829 billion over the next decade in new revenue. The old Pelosi plan, to return to pre-Bush rates on all income over $1 million would raise about half as much, around $463 billion. Here’s a visualization, courtesy of the Center for Budget and Policy Priorities.

The missing $366 billion would need to be found somewhere if the budget is to be brought into balance, a task that is estimated to entail about $3 trillion in spending cuts and tax increases over the next decade. So where would that money come from? There are only so many answers: Entitlements like Social Security and Medicare, other tax increases by reducing things like the home mortgage deduction, defense spending cuts or cuts to discretionary spending that Democrats often say is essential. As the CBPP puts it, “By forgoing $366 billion in revenue, maintaining all of the Bush tax cuts on the first $1 million of wealthy households’ incomes ultimately would likely lead to much deeper cuts in these other parts of the budget.”

In short, the same logic that underscores the President’s attack on Republicans works against those Democrats who want to continue lower tax rates on incomes between $250,000 and $1 million. If you are serious about reducing deficits to a sustainable level–and there is lots of evidence than many in Washington are not–you have to find the money somewhere. And if it does not come from the wealthy, it will come from the less wealthy. The era of everybody wins is coming to an end.