Since Barack Obama arrived in office, he has predicted a return to stable deficits in the out years, the sort of message that lawmakers, creditors and the American people like to here. But there is problem: Obama’s projections have consistently been too rosy. So each year, his bean counters must readjust the projections. They keep the rosy out-year vision, while admitting that the short term is more grim than they anticipated.

For example, in 2009, the White House projected a 2010 deficit of 8% of GDP. A year later, the 2010 deficit was running at 10.6% of GDP, or 32% higher than projections. The same thing happened the next year. In 2010, the White House projected a 2011 deficit of 8.3%. A year later, that number had been adjusted to 10.9%, or 31% higher. The errors are even worse when the projections are measured a couple years out: In 2009, the White House thought the 2012 deficit would be just 3.5%. This year, Obama thinks the deficit next year will be 7%, or twice as much.

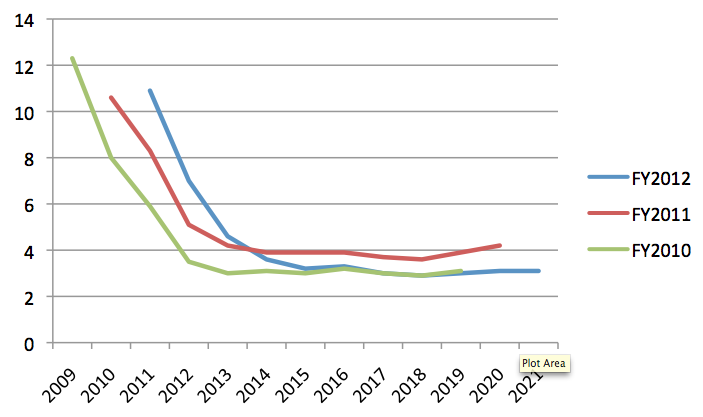

Please forgive my Excel skills but I have tried to chart these shifts below. It’s a little complicated to look at, but let me explain. The three lines show the 10-year deficit projections (as a percentage of GDP) that were made in the FY2010, FY2011 and FY2012 Obama budgets. The numbers on the left are percentage points of GDP that the deficit is expected to run. (The higher the line, the higher the deficits.) You can see that the FY2010 projections were all revised upwards the following year. And that the FY2011 projections were revised upward again in the short term a year later, though the out years look better.

The problem this chart shows is how wobbly projections handicap the budgetary discussion. A cynic would say it shows how things are bad, even though history shows that they will be worse. In 2009, Obama called his budget “A New Era of Responsibility.” It was not that. As we now know, it was a dramatic understatement of how unstable our fiscal situation has become. This is less a result of Obama deception than the fact that the economy crashed far harder than anyone expected, and the Congress, with Obama’s assent, spent more and collect less taxes than expected. While the former might turn around, I am not all that optimistic on the latter.

So just how good are the projections today? Not so much, is my guess, though we have no choice but to use them. Under the White House projections released today, deficits will flatten out at about 3% of GDP–an ostensibly sustainable level if the economy grows at about 3%–starting in 2015. That may be true, but since the bean counters at OMB have not been right yet, I am not holding my breath.